4 ways customer expectations have evolved

minutes

Actionable insights to adapt to the new era of customer relationships

Take a trip to any customer service summit and you’ll hear the same lament from savvy customer service leaders—what worked a decade ago doesn’t work today. Customer expectations have evolved to demand greater speed, coordination, and quality.

How can customer service organizations keep pace? By understanding the key drivers behind shifting customer expectations, and then adopting (or at least testing) new strategies to deliver on these expectations. A company’s promise is more than a product or service—it’s the total customer experience with every point of contact—and too often, they fall short.

Here are four trends to help you identify ways to evolve your customer service approach:

Customers expect faster access

According to Forrester Research, 71% of consumers say that “valuing their time” is the most important thing a company can do in customer service. Considering that time on hold is the #1 complaint among consumers on Twitter, it is self-evident that many brands haven’t created the flexibility needed to respond when a holiday, new product, promotion or other event causes a major surge in calls.

Companies should make solving this problem a priority because it directly impacts their bottom line—according to a survey by American Express, 78% of consumers have bailed on a transaction or not made an intended purchase because the poor service experience.

Customers expect that companies have figured out the capacity issue, but when customer service departments over-staff to accommodate call spikes and the calls don’t come, this results in wasted idle time for agents.

Actionable insight: A more cost-effective solution is a workforce of on-demand virtual agents, who work only when there is customer demand.

Customers expect technology to work together seamlessly

With so many systems—from point of sale (POS) to customer relationship management (CRM) to specialized databases for customer medical records or even car-maintenance records—it’s little wonder that system integration can be tricky.

But customers don’t care that integration is tricky. They care that the customer service agent helps in a timely and efficient manner. Customer complaints in this area range from an agent asking for an account number that the customer just provided to the IVR (interactive voice response), to being stuck on long hold times while agents access necessary information from each system.

Actionable insight: You can set your organization up for success by working with your contact center provider to integrate with key systems to create a seamless customer experience.

Read a case study on how Liveops does this for a major pharmaceutical company.

Customers expect a high level of security

Customers don’t know much about what goes on behind the scenes at a contact center, but after seeing myriad data breaches by some of the world’s biggest brands, they expect that companies will make the maximum effort to protect customer data.

The problem is that customers service executives assume that security measures typically used in traditional brick-and-mortar contact centers—such as no paper on desks, personal items like cell phones put away in lockers, and only supervisors looking over employees’ shoulders—are the best option.

However, most don’t know that according to the FBI Uniform Crime Report, traditional contact center employees are actually 300% more likely to commit theft or larceny than agents who work from home, and 180% more likely to commit forgery or fraud compared to WAH (work-at-home) agents.

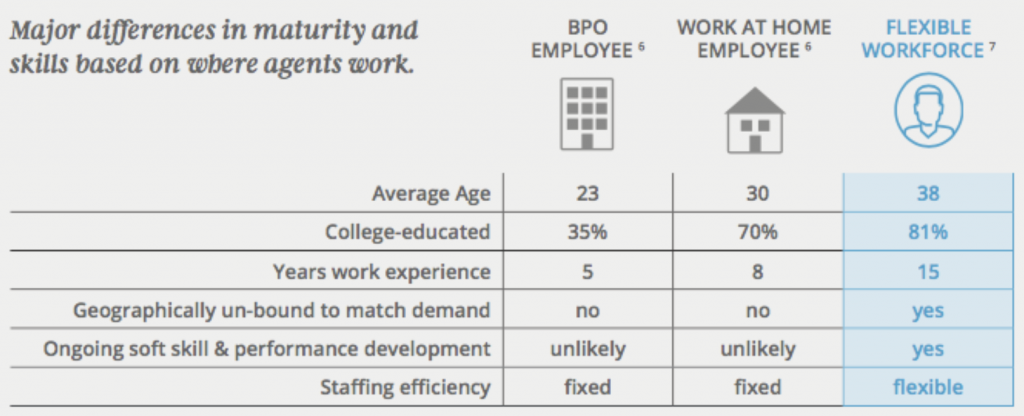

Why are WAH agents more trustworthy? We think it’s a combination of their tendency to be more mature and experienced—and therefore having a greater appreciation for the consequences of bad actions—and having a greater degree of investment in their jobs.

Liveops’ virtual agents work from home and invest their own time and money in developing skills and setting up their offices to provide services for Liveops clients. They have a vested interest in protecting customer security because it’s not just a job—it’s their own business on the line.

Actionable insight: Dig deeper into your assumptions about contact center security, considering how a more mature and invested virtual workforce could provide greater security for customer information.

Customers expect more automation

According to research by Gartner, 80% of customer interactions will be automated by 2020. That trend is already marching forward as contact centers strive to reduce incoming calls through automation by identifying routine issues and routing them through IVR.

That means the remaining 20% of calls are the complex, challenging, exception-not-the-rule type of issues that will really stand out to customers in terms of their service experience.

They’re not calling to check a routine bank balance. They’re calling to request an exception to an overdraft fee due to a processing error on their last deposit at the ATM.

Companies that do voice work well will be held in high esteem by customers who are accustomed to “press 5 for [insert a menu item]”-type service. Consumer Reports research showed that 67% of American adults have hung up in the past year out of frustration because they couldn’t reach a real person.

Actionable insight: With the savings of moving more voice calls to IVR, invest in top-quality agents who can take calls that need an extra measure of expertise, empathy, and knowledge to solve the customer’s problem.

Knowing your customers and anticipating their expectations—thinking through each of these ways expectations have evolved—is key to developing exceptional customer experiences. Understanding your customers is what will separate you from your competition in an economy where product and services can otherwise so quickly be replaced.